How Enterprise Architecture Drives Real Business Value: Four Key Impact Areas

In today’s fast-paced digital landscape, Enterprise Architecture (EA) often gets misunderstood or overlooked. While IT teams have well-defined roles—developers build, operations support, security protects—EA can sometimes struggle to clearly explain its value. But what if EA was the secret weapon that aligns business strategy and technology to unlock measurable growth, reduce costs, and guide transformational decisions?

In this post, we explore four ways Enterprise Architecture delivers real, quantifiable business value—and the metrics that prove it.

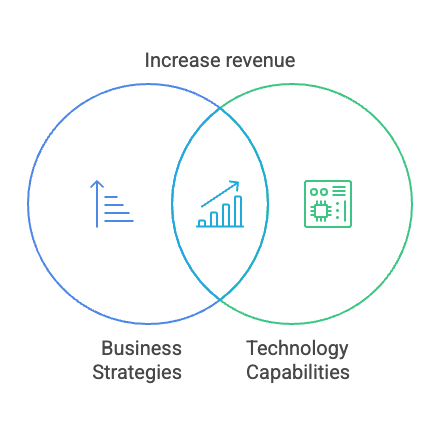

EA: The Art of Aligning Business and Technology

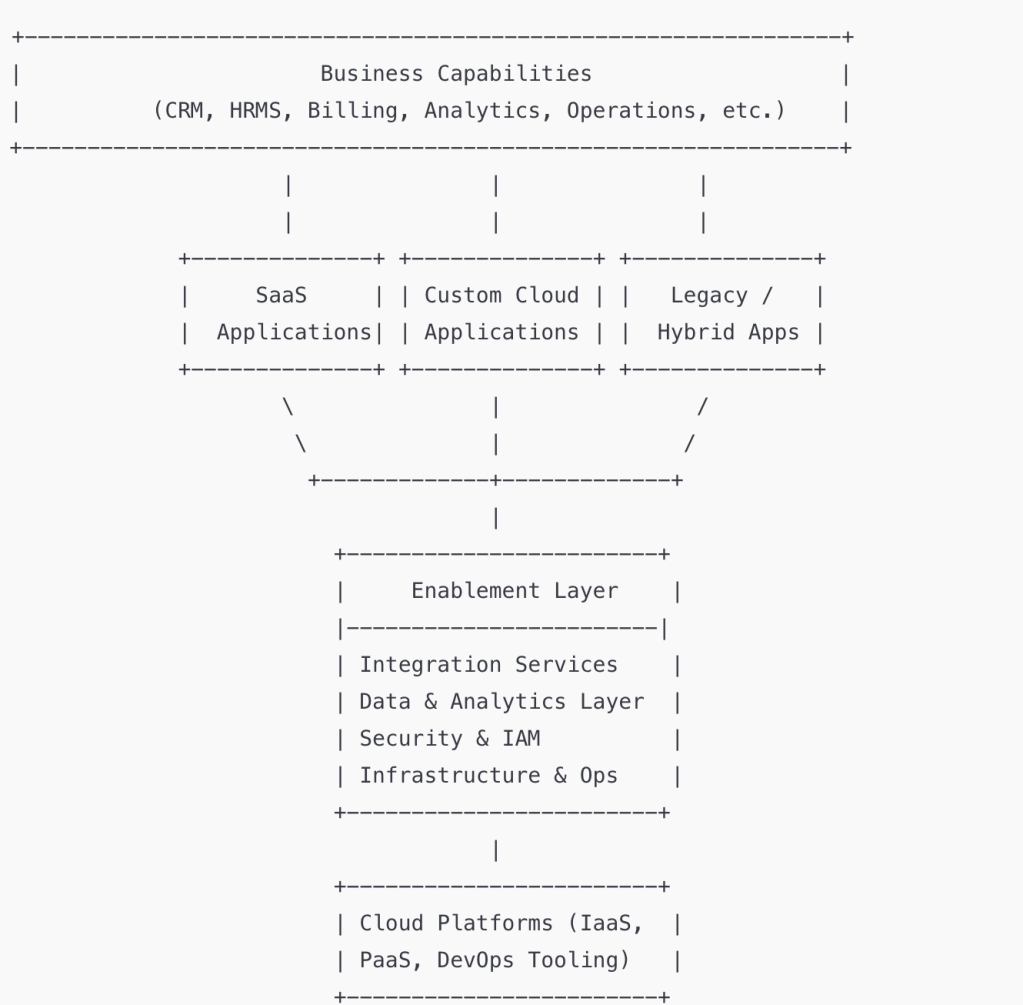

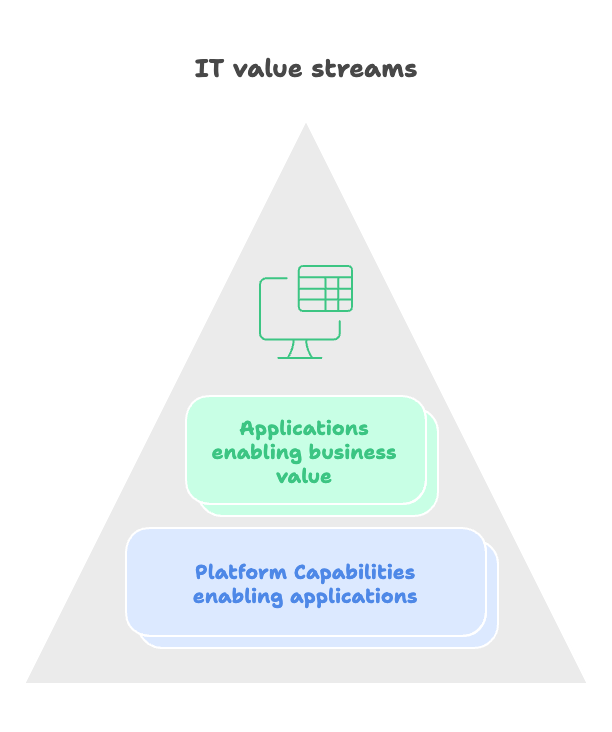

At its core, Enterprise Architecture is about aligning business strategies—typically focused on increasing revenue or cutting costs—with technology initiatives that support those goals. By mapping business strategies to technology capabilities, EA uncovers opportunities that directly impact revenue growth or cost reduction.

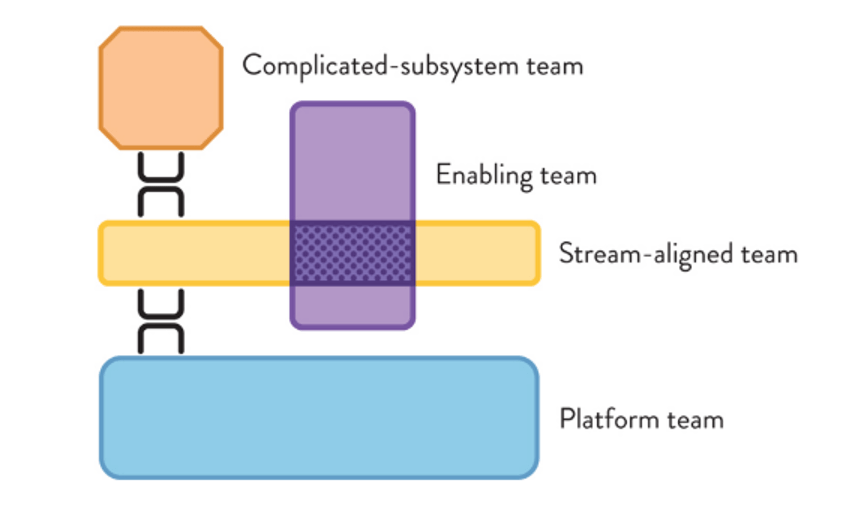

Enterprise Architects serve as co-sponsors alongside business leaders on projects, owning the technology components that span multiple teams. This cross-team ownership enables projects to deliver clearly traceable business outcomes.

Key Metrics to Track EA Value:

- Number of EA-sponsored initiatives tied to business costs or revenue goals

- Total value delivered (e.g., dollars saved, increased operating income or revenue)

- Time-to-value for EA-led projects

- Business stakeholder satisfaction (survey or NPS scores)

Example: A health insurer wants to reduce claim adjudication time. EA identifies automation opportunities and architects an AI-driven system that cuts processing time by 40%.

Optimizing Technology Spend for Maximum Impact

Another vital role for EA is managing and optimizing technology investments. Enterprise Architects should own the oversight of tech spend, spotting redundancies and opportunities for consolidation. More than just technology choices, this involves financial analysis—like net present value (NPV)—to ensure migration or transformation initiatives deliver positive returns.

A common approach is to control spending on legacy systems while onboarding new platforms for evolving needs, retiring outdated technologies as part of larger transformation efforts.

Key Metrics to Track Spend Optimization:

- Percentage of technology spend reviewed by EA

- NPV of rationalization initiatives

- Percentage of optimization ideas executed

Example: EA discovers three business units using different document management tools. By consolidating to a single modular platform, the organization saves $1.2 million annually and simplifies employee training.

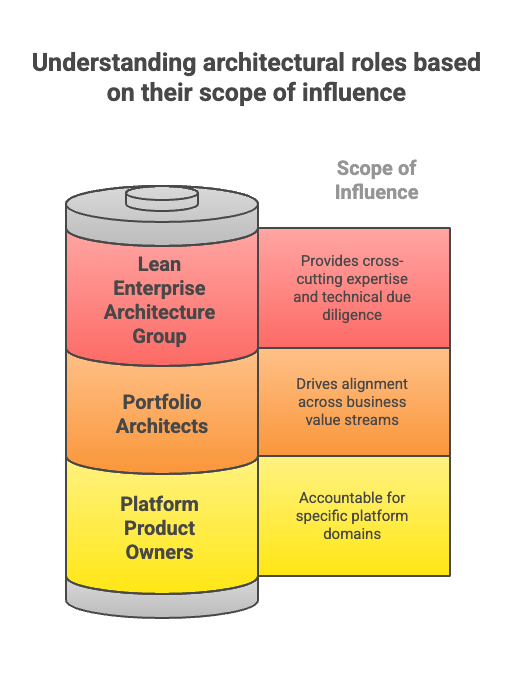

EA as an Internal Consulting Partner

Enterprise Architecture can also act as an internal consulting arm supporting both CIOs and business leaders. To do this effectively, EAs must bring not only have technical expertise but also industry-specific knowledge—akin to consulting firms like McKinsey or Deloitte. The operating model for EA needs to evolve as we will see in subsequent post to include leaders from domains such as Product, and Business Subject matter experts.

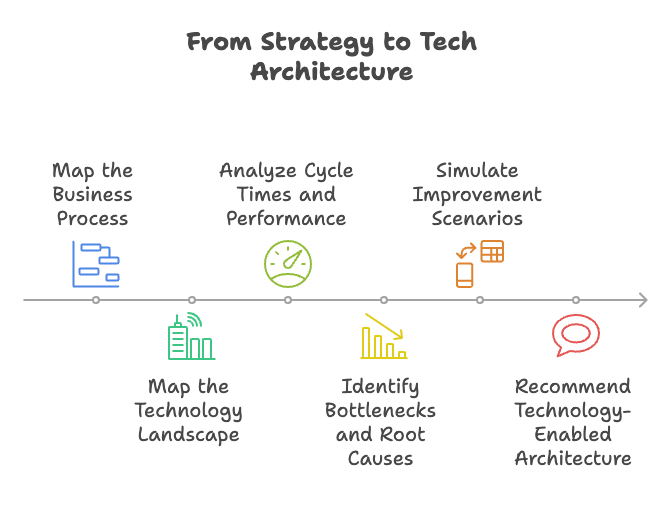

By leading focused engagements on specific business challenges, EA teams guide strategic problem-solving and operational improvements.

Key Metrics for Consulting Impact:

- Number of business-initiated EA engagements

- Impact on operational KPIs driven by EA-backed changes

Example: EA facilitates a discovery workshop with clinical operations to improve pre-op and post-op workflows. They design a new process supported by automation and patient-facing apps, reducing no-show rates by 15%.

Guiding Strategic Decisions in Large Transformations

Finally, Enterprise Architecture plays a critical role in guiding major transformation programs. By gathering detailed information on current state architectures, EAs inform crucial decisions—like infrastructure choices—that can be quantified in terms of business value. Most organization undergo large transformation to replace legacy systems, embrace cloud, data and AI technologies which are often informed by key initial decisions that shape the technology trajectory

These insights ensure transformations align with both technical realities and business objectives.

Key Metrics to Measure Strategic Influence:

- Percentage of strategic decisions influenced by EA

- Estimated business value enabled by EA guidance

Example: EA conducts a review of infrastructure across multiple facilities and recommends a hybrid cloud approach that complies with regional data laws while enabling advanced AI analytics for population health initiatives.

Conclusion

Enterprise Architecture isn’t just about frameworks and diagrams—it’s a powerful business enabler that connects strategy to technology, optimizes spend, drives internal consulting, and shapes transformative decisions. By focusing on measurable outcomes, EA can clearly demonstrate its value and become a trusted partner in achieving organizational goals.